Taxpayers can deduct up to 10000 of. Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Trumps 2017 tax cut capped the previously unlimited SALT deduction at 10000 hurting taxpayers who itemize their deductions especially those in high-tax states.

. To help pay for that increase SALT deductions were. Democrats have limited legislative paths to expand the federal deduction for state and local. Perhaps the most controversial provision of the Tax Cuts and Jobs Act of 2017 is the state and local tax deduction limitation or SALT cap particularly with respect to how the.

The legislation also requires that anyone claiming the SALT deduction must attest that they do not have total assets worth more than 1 billion. December 19 2021 1131 AM PST Updated on December 19 2021 107 PM PST. A congressional battle line was forming last week over former President Donald Trumps SALT tax cap which is threatening to derail President Joe Bidens 2 trillion infrastructure proposal.

However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. The TCJA reduced the. Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law which reduced.

It wasnt until ten paragraphs into the report that NBC News acknowledges the SALT provisions would give two-thirds of people making more than a million dollars a tax cut. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms.

But the Tax Cuts and Jobs Act limited that deduction to 10000. Seventeen states have enacted SALT cap workaround laws and several. The provision in question would roll back the 10000 limit on the SALT deduction that was established by Republicans 2017 tax law signed by former President Trump.

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. Organizing an LLC for your business can convert non-deductible SALT into a business expense. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction.

The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. That was bad news for top earners in blue states such as California and New York. On average a mere 138 percent of constituents living in districts represented by SALT Caucus members will receive more than 80 percent of the total tax cut if the SALT cap is.

The current Democrat-controlled House passed a bill in 2021 that would temporarily raise the cap to 80000 until 2031 when it would go back to 10000. Paying a state income tax. The 10000 cap was part of the.

House Democrats have proposed increasing the state and local taxes or SALT cap to 72500 from 10000 through 2031. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending plan. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

While all attention these days seems to be focused on that other Supreme Court case we want to point out that two weeks ago the Court tersely refused to consider a.

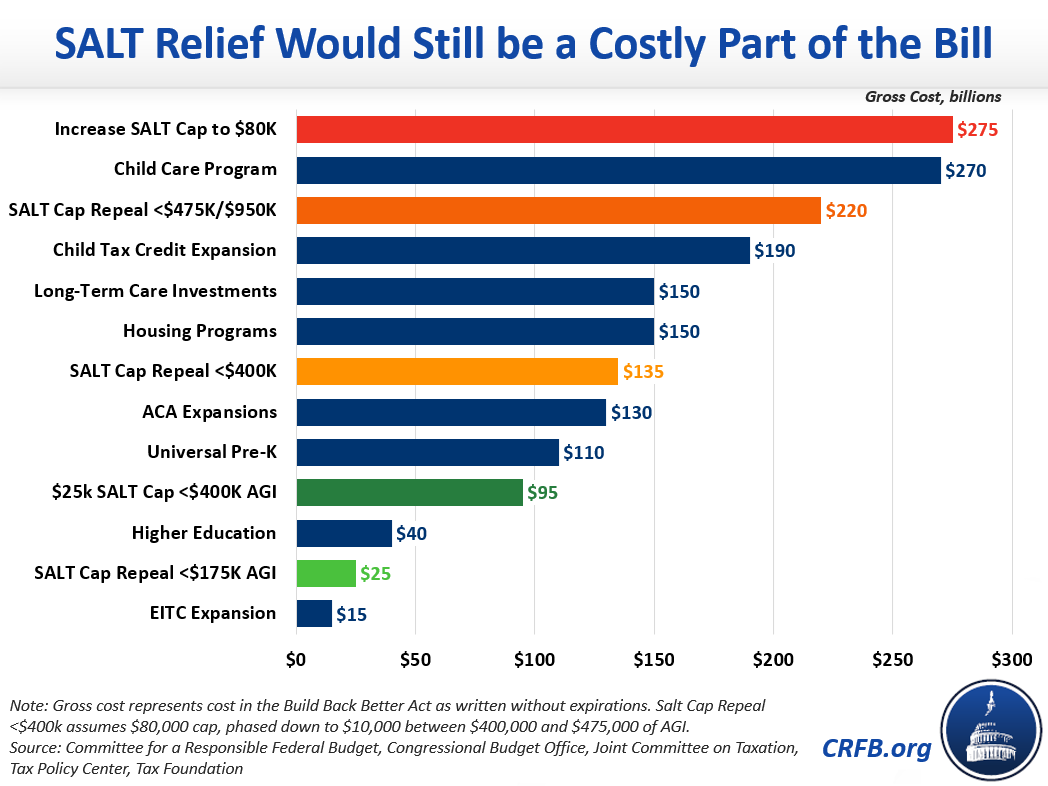

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Salt Price Marketcap Chart And Info Coingecko Price Chart Cryptocurrency Cryptocurrency Market Capitalization

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

We Re No 51 Utah Last Again For Per Student Spending Tuition Vocational School Bloomberg Business

From Kazakhstan To Uzbekistan How Cryptocurrencies Are Regulated In Central Asia Cryptocurrency News Central Asia Cryptocurrency

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

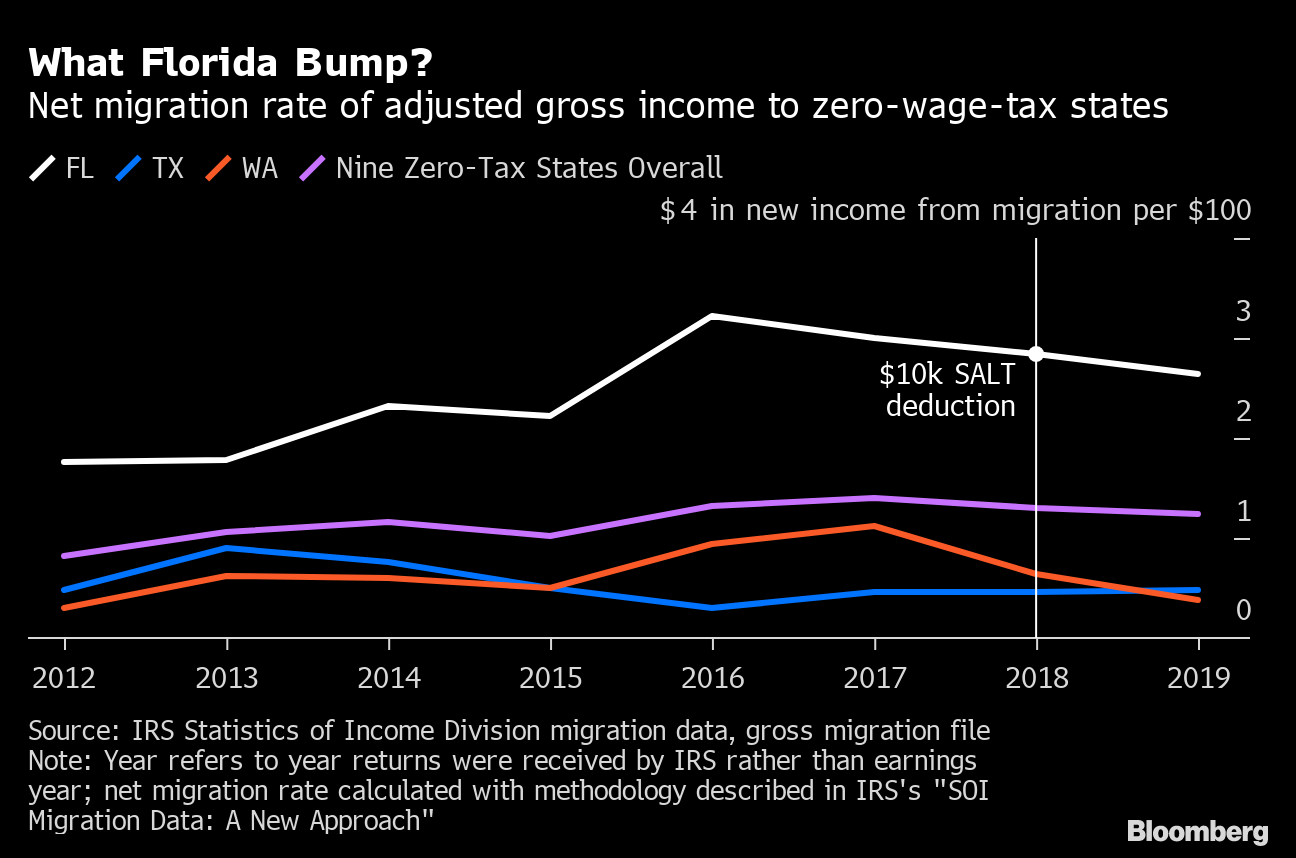

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg